Solution in MATLAB Environment

Table 1. Solutions of the Problem 1

Table 2. Solutions of the Problem 2

Table 3. Solutions of the Problem 3

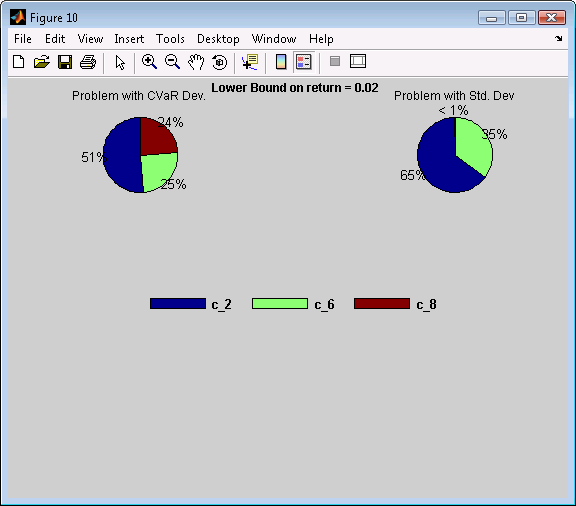

Figure 1. Efficient Frontier for Problem 1

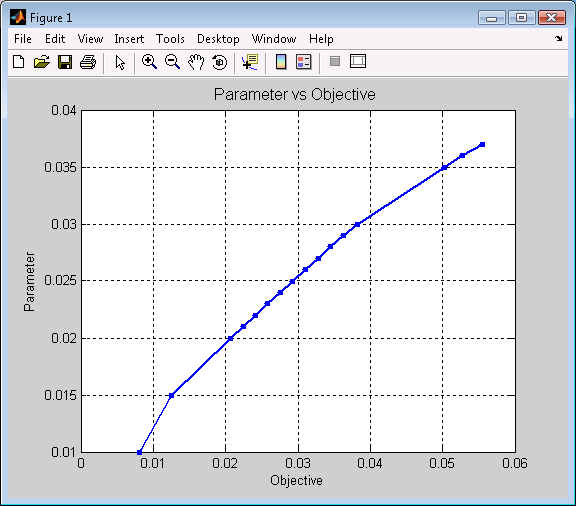

Figure 2. Efficient Frontier for Problem 2

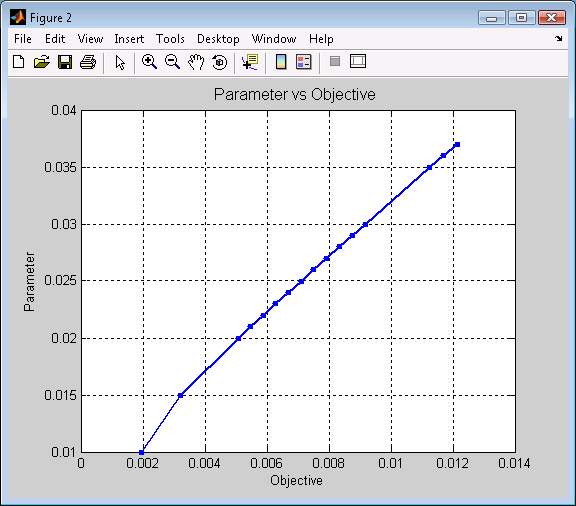

Figure 3. Efficient Frontier for Problem 3

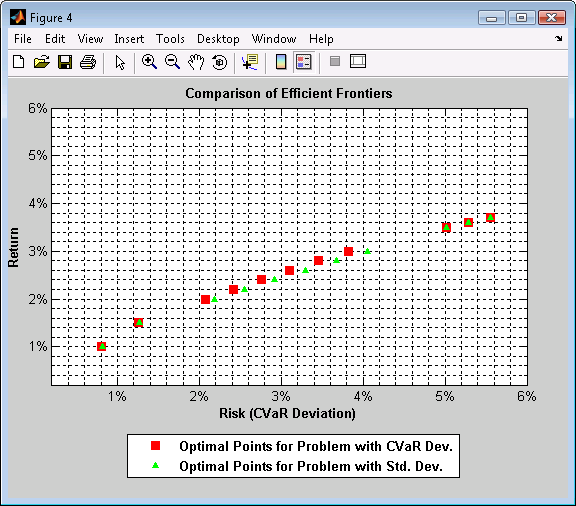

Figure 4. Comparison of Efficient Frontiers

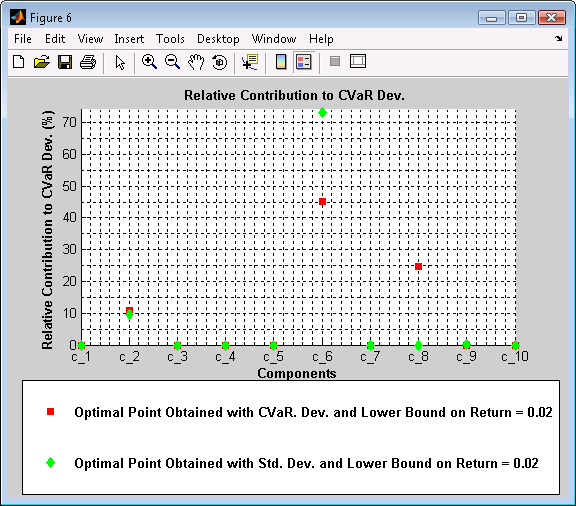

Figure 6. Relative Contribution to CVaR Dev.

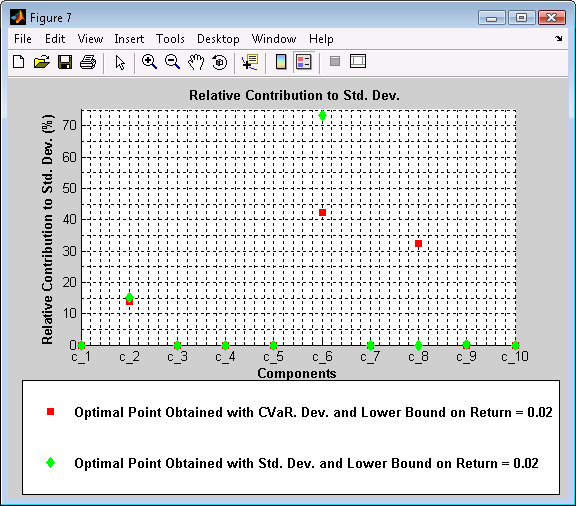

Figure 7. Relative Contribution to Std. Dev.

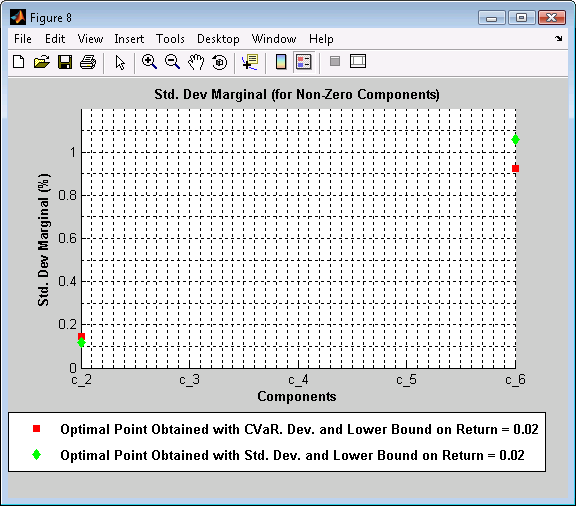

Figure 8. Std. Dev Marginal (for Non-Zero Components)

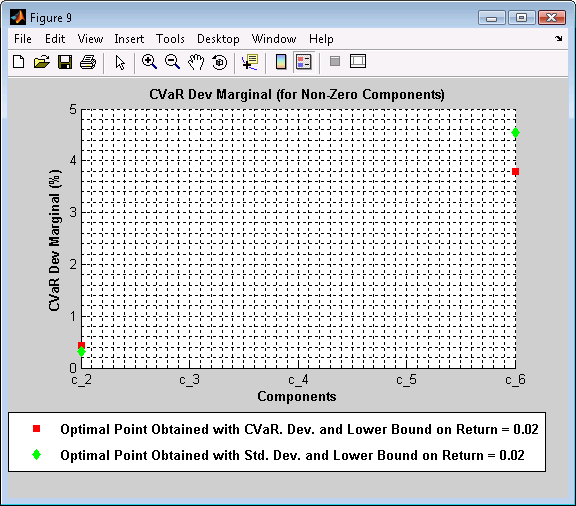

Figure 9. CVaR Dev Marginal (for Non-Zero Components)

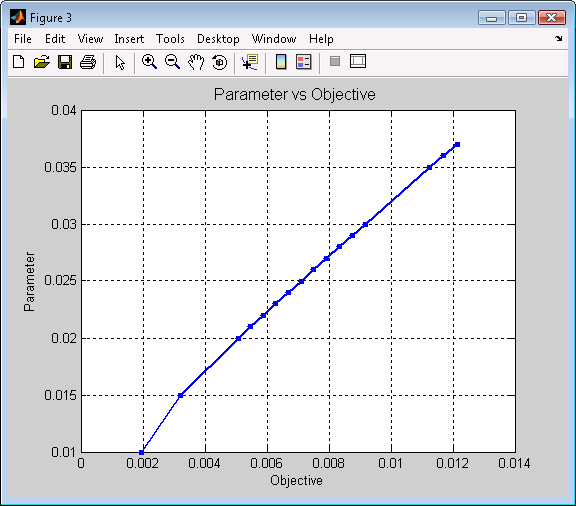

Figure 10. Lower Bound on return = 0.02

Case study Portfolio Optimization, CVaR vs Standard Deviation (see Formal Problem Statement) in MATLAB Environment is solved with riskparam PSG subroutine and includes three risk minimization problems:

| • | Problem 1 (CS.1 - CS.4): risk is measured by CVaR deviation. |

| • | Problem 2 (CS.5 - CS.8): risk is measured by standard deviation calculated by using the covariance matrix. |

| • | Problem 3 (CS.9 - CS.12): risk is measured by standard deviation calculated with the matrix of scenarios. |

MATLAB code for Portfolio Optimization with Nonlinear Transaction Costs is in file CS_Portfolio_Optimization_CVaR_vs_ST_DEV.m.

Data are saved in files Portfolio_Optimization_CVaR_vs_ST_DEV.mat.

All three problems are run with several values of r = 0.01, 0.015, 0.02, 0.021, 0.022, 0.023, 0.024, 0.025, 0.026, 0.027, 0.028, 0.029, 0.03, 0.035, 0.036, and 0.037 in the constraints (CS.3), (CS.7), and (CS.11), correspondingly.

Let us describe the main operations. To run case study you need to do the following main steps:

In file CS_Portfolio_Optimization_CVaR_vs_ST_DEV.m :

Specify a set of values of parameter parameter (upper bound on risk) for which runs should be conducted:

Parameters_pos = [0.01 0.015 0.02 0.021 0.022 0.023 0.024...

0.025 0.026 0.027 0.028 0.029 0.03 0.035 0.036 0.037];

Change the sign of parameter (constraint on the portfolio rate of return) to reduce the constraint (CS.2) to the form used by riskparam subroutine.

Parameters = Parameters_pos*(-1);

Load data:

load('Portfolio_Optimization_CVaR_vs_ST_DEV.mat');

Solve the optimization Problem 1 (CS.1) - (CS.4).

Set solver options:

stroptions.Solver = 'VAN';

stroptions.Precision = 5;

Set graph options:

stroptions.PlotGraph = 'On';

stroptions.PlotType = 2;

Set the scale for parameter. Since we change the parameter sign minus sign ("-") to adapt it to the standard constraint statement for riskparam function, we change sign to achieve the initial values of the parameter:

stroptions.ScaleParam = -1;

Optimize problem for specified values of the parameter:

[Objectives, Parameters, Points, GraphHandle]=riskparam ('cvar_dev', 0.99, H, c, p, [],... A, b, Aeq, beq, lb, [], 'b', [],[],[],[], [], Parameters, [], stroptions); Points_cvar = Points; |

Create string array for components:

for i=1:size(component_name_arr)

comp_alias {i} = strcat('c_',int2str(i));

end

Display the resulting table (Table 1):

n=12;

l=1;

for k=1:4

fprintf('\n%27s','Constraint on the portfolio');

fprintf('\n%27s',' rate of return');

for i=l:1:length(Parameters)-n

fprintf('%16.6f', Parameters(i));

end

fprintf('\n%27s','Portfolio CVaR deviation');

for i=l:1:length(Parameters)-n

fprintf('%16.5E', Objectives(i));

end

fprintf('\n%27s','Optimal value of components');

for j=1:size(component_name_arr)

fprintf('\n%27s', component_name_arr {j});

for i=l:1:length(Parameters)-n

fprintf('%16f', Points_cvar(i,j));

end

end

fprintf('\n');

n = n - 4;

l= l + 4;

end

fprintf('\n');

fprintf('\n');

Solve the optimization Problem 2 (CS.5) - (CS.8).

Optimize problem for specified values of the parameter:

[Objectives, Parameters, Points, GraphHandle]=riskparam ('st_dev', [], H_cov, [], [], [],... A, b, Aeq, beq, lb, [], 'b', [],[],[],[], [], Parameters, [], stroptions); Points_stdev_covar = Points; |

Display the resulting table (Table 2):

n=12;

l=1;

for k=1:4

fprintf('\n%27s','Constraint on the portfolio');

fprintf('\n%27s',' rate of return');

for i=l:1:length(Parameters)-n

fprintf('%16.6f', Parameters(i));

end

fprintf('\n%27s','Minimal risk measured');

fprintf('\n%27s','by standard deviation');

fprintf('\n%27s','calculated with the');

fprintf('\n%27s','covariance matrix');

for i=l:1:length(Parameters)-n

fprintf('%16.5E', Objectives(i));

end

fprintf('\n%27s','Optimal value of components');

for j=1:size(component_name_arr)

fprintf('\n%27s', component_name_arr {j});

for i=l:1:length(Parameters)-n

fprintf('%16f', Points_stdev_covar(i,j));

end

end

fprintf('\n');

n = n - 4;

l= l + 4;

end

fprintf('\n');

fprintf('\n');

Solve the optimization Problem 3 (CS.9) - (CS.12).

Optimize problem for specified values of the parameter:

[Objectives, Parameters, Points, GraphHandle]=riskparam ('st_dev', [], H, [], [], [],... A, b, Aeq, beq, lb, [], 'b', [],[],[],[], [], Parameters, [], stroptions); Points_stdev_scenar = Points; |

Display the resulting table:

n=12;

l=1;

for k=1:4

fprintf('\n%27s','Constraint on the portfolio');

fprintf('\n%27s',' rate of return');

for i=l:1:length(Parameters)-n

fprintf('%16.6f', Parameters(i));

end

fprintf('\n%27s','Minimal risk measured');

fprintf('\n%27s','by standard deviation');

fprintf('\n%27s','calculated with the');

fprintf('\n%27s','scenarios matrix');

for i=l:1:length(Parameters)-n

fprintf('%16.5E', Objectives(i));

end

fprintf('\n%27s','Optimal value of components');

for j=1:size(component_name_arr)

fprintf('\n%27s', component_name_arr {j});

for i=l:1:length(Parameters)-n

fprintf('%16f', Points_stdev_scenar(i,j));

end

end

fprintf('\n');

n = n - 4;

l= l + 4;

end

fprintf('\n');

fprintf('\n');

Table 1. Solutions of the Problem 1

Constraint on the portfolio

rate of return 0.010000 0.015000 0.020000 0.021000

Portfolio CVaR deviation 8.08908E-003 1.25053E-002 2.07331E-002 2.24266E-002

Optimal value of components

cluster_1 0.235648 0.011749 0.000000 0.000000

cluster_2 0.750333 0.793330 0.514213 0.446486

cluster_3 0.000000 0.000000 0.000000 0.000000

cluster_4 0.000000 0.000000 0.000000 0.000000

cluster_5 0.000000 0.000000 0.000000 0.000000

cluster_6 0.014019 0.142256 0.247457 0.261744

cluster_7 0.000000 0.000000 0.000000 0.000000

cluster_8 0.000000 0.052665 0.238329 0.291770

cluster_9 0.000000 0.000000 0.000000 0.000000

cluster_10 0.000000 0.000000 0.000000 0.000000

Constraint on the portfolio

rate of return 0.022000 0.023000 0.024000 0.025000

Portfolio CVaR deviation 2.41201E-002 2.58271E-002 2.75494E-002 2.92779E-002

Optimal value of components

cluster_1 0.000000 0.000000 0.000000 0.000000

cluster_2 0.378758 0.314791 0.255058 0.195595

cluster_3 0.000000 0.000000 0.000000 0.000000

cluster_4 0.000000 0.000000 0.000000 0.000000

cluster_5 0.000000 0.000000 0.000000 0.000000

cluster_6 0.276031 0.293249 0.313767 0.334496

cluster_7 0.000000 0.000000 0.000000 0.000000

cluster_8 0.345211 0.391960 0.431175 0.469909

cluster_9 0.000000 0.000000 0.000000 0.000000

cluster_10 0.000000 0.000000 0.000000 0.000000

Constraint on the portfolio

rate of return 0.026000 0.027000 0.028000 0.029000

Portfolio CVaR deviation 3.10216E-002 3.27653E-002 3.45089E-002 3.63177E-002

Optimal value of components

cluster_1 0.000000 0.000000 0.000000 0.000000

cluster_2 0.140728 0.085861 0.030994 0.000000

cluster_3 0.000000 0.000000 0.000000 0.000000

cluster_4 0.000000 0.000000 0.000000 0.000000

cluster_5 0.000000 0.000000 0.000000 0.000000

cluster_6 0.358808 0.383120 0.407431 0.450351

cluster_7 0.000000 0.000000 0.000000 0.000000

cluster_8 0.500464 0.531019 0.561574 0.549649

cluster_9 0.000000 0.000000 0.000000 0.000000

cluster_10 0.000000 0.000000 0.000000 0.000000

Constraint on the portfolio

rate of return 0.030000 0.035000 0.036000 0.037000

Portfolio CVaR deviation 3.82550E-002 5.01961E-002 5.28031E-002 5.55696E-002

Optimal value of components

cluster_1 0.000000 0.000000 0.000000 0.000000

cluster_2 0.000000 0.000000 0.000000 0.000000

cluster_3 0.000000 0.000000 0.000000 0.000000

cluster_4 0.000000 0.000000 0.000000 0.000000

cluster_5 0.000000 0.000000 0.000000 0.000000

cluster_6 0.517432 0.852834 0.919914 0.986994

cluster_7 0.000000 0.000000 0.000000 0.000000

cluster_8 0.482568 0.147166 0.080086 0.013006

cluster_9 0.000000 0.000000 0.000000 0.000000

cluster_10 0.000000 0.000000 0.000000 0.000000

Table 2. Solutions of the Problem 2

Constraint on the portfolio

rate of return 0.010000 0.015000 0.020000 0.021000

Minimal risk measured

by standard deviation

calculated with the

covariance matrix 2.37888E-005 3.46085E-005 4.64318E-005 4.88448E-005

Optimal value of components

cluster_1 0.151210 0.000000 0.000000 0.000000

cluster_2 0.848790 0.836625 0.648144 0.610448

cluster_3 -0.000000 -0.000000 -0.000000 -0.000000

cluster_4 0.000000 0.000000 0.000000 0.000000

cluster_5 0.000000 0.000000 -0.000000 -0.000000

cluster_6 0.000000 0.163375 0.351856 0.389552

cluster_7 -0.000000 -0.000000 -0.000000 -0.000000

cluster_8 0.000000 0.000000 0.000000 0.000000

cluster_9 0.000000 0.000000 0.000000 0.000000

cluster_10 0.000000 0.000000 -0.000000 0.000000

Constraint on the portfolio

rate of return 0.022000 0.023000 0.024000 0.025000

Minimal risk measured

by standard deviation

calculated with the

covariance matrix 5.12687E-005 5.37019E-005 5.61434E-005 5.85919E-005

Optimal value of components

cluster_1 0.000000 0.000000 0.000000 0.000000

cluster_2 0.572752 0.535055 0.497359 0.459663

cluster_3 -0.000000 -0.000000 -0.000000 -0.000000

cluster_4 0.000000 0.000000 0.000000 -0.000000

cluster_5 -0.000000 -0.000000 -0.000000 0.000000

cluster_6 0.427248 0.464945 0.502641 0.540337

cluster_7 -0.000000 -0.000000 -0.000000 -0.000000

cluster_8 0.000000 0.000000 0.000000 -0.000000

cluster_9 0.000000 0.000000 0.000000 -0.000000

cluster_10 0.000000 0.000000 0.000000 0.000000

Constraint on the portfolio

rate of return 0.026000 0.027000 0.028000 0.029000

Minimal risk measured

by standard deviation

calculated with the

covariance matrix 6.10468E-005 6.35072E-005 6.59725E-005 6.84422E-005

Optimal value of components

cluster_1 0.000000 0.000000 0.000000 0.000000

cluster_2 0.421967 0.384271 0.346574 0.308878

cluster_3 -0.000000 -0.000000 -0.000000 -0.000000

cluster_4 -0.000000 -0.000000 -0.000000 -0.000000

cluster_5 0.000000 0.000000 0.000000 -0.000000

cluster_6 0.578033 0.615729 0.653426 0.691122

cluster_7 -0.000000 -0.000000 -0.000000 -0.000000

cluster_8 -0.000000 0.000000 0.000000 0.000000

cluster_9 -0.000000 -0.000000 -0.000000 -0.000000

cluster_10 0.000000 0.000000 0.000000 0.000000

Constraint on the portfolio

rate of return 0.030000 0.035000 0.036000 0.037000

Minimal risk measured

by standard deviation

calculated with the

covariance matrix 7.09159E-005 8.33311E-005 8.58215E-005 8.83140E-005

Optimal value of components

cluster_1 0.000000 0.000000 0.000000 -0.000000

cluster_2 0.271182 0.082701 0.045005 0.007309

cluster_3 -0.000000 0.000000 0.000000 0.000000

cluster_4 0.000000 0.000000 0.000000 -0.000000

cluster_5 0.000000 -0.000000 -0.000000 0.000000

cluster_6 0.728818 0.917299 0.954995 0.992691

cluster_7 -0.000000 0.000000 0.000000 0.000000

cluster_8 0.000000 0.000000 0.000000 0.000000

cluster_9 0.000000 0.000000 0.000000 0.000000

cluster_10 -0.000000 -0.000000 -0.000000 -0.000000

Table 3. Solutions of the Problem 3

Constraint on the portfolio

rate of return 0.010000 0.015000 0.020000 0.021000

Minimal risk measured

by standard deviation

calculated with the

scenarios matrix 1.95090E-003 3.20525E-003 5.07643E-003 5.47566E-003

Optimal value of components

cluster_1 0.151210 0.008762 0.000000 0.000000

cluster_2 0.848790 0.826408 0.648144 0.607385

cluster_3 -0.000000 -0.000000 -0.000000 -0.000000

cluster_4 0.000000 -0.000000 0.000000 0.000000

cluster_5 -0.000000 -0.000000 -0.000000 0.000000

cluster_6 0.000000 0.164830 0.351856 0.387165

cluster_7 -0.000000 -0.000000 -0.000000 -0.000000

cluster_8 0.000000 0.000000 0.000000 0.005451

cluster_9 0.000000 0.000000 0.000000 0.000000

cluster_10 -0.000000 -0.000000 -0.000000 -0.000000

Constraint on the portfolio

rate of return 0.022000 0.023000 0.024000 0.025000

Minimal risk measured

by standard deviation

calculated with the

scenarios matrix 5.87832E-003 6.28360E-003 6.69101E-003 7.10020E-003

Optimal value of components

cluster_1 0.000000 0.000000 0.000000 0.000000

cluster_2 0.563271 0.519157 0.475043 0.430929

cluster_3 -0.000000 -0.000000 -0.000000 -0.000000

cluster_4 0.000000 0.000000 -0.000000 -0.000000

cluster_5 0.000000 0.000000 0.000000 -0.000000

cluster_6 0.419858 0.452552 0.485245 0.517939

cluster_7 -0.000000 -0.000000 -0.000000 -0.000000

cluster_8 0.016871 0.028291 0.039712 0.051132

cluster_9 0.000000 0.000000 0.000000 0.000000

cluster_10 -0.000000 -0.000000 0.000000 0.000000

Constraint on the portfolio

rate of return 0.026000 0.027000 0.028000 0.029000

Minimal risk measured

by standard deviation

calculated with the

scenarios matrix 7.51086E-003 7.92277E-003 8.33575E-003 8.74965E-003

Optimal value of components

cluster_1 0.000000 0.000000 0.000000 0.000000

cluster_2 0.386815 0.342701 0.298587 0.254473

cluster_3 -0.000000 -0.000000 -0.000000 -0.000000

cluster_4 -0.000000 -0.000000 -0.000000 0.000000

cluster_5 0.000000 0.000000 0.000000 -0.000000

cluster_6 0.550632 0.583326 0.616019 0.648713

cluster_7 -0.000000 -0.000000 -0.000000 -0.000000

cluster_8 0.062553 0.073973 0.085394 0.096814

cluster_9 0.000000 0.000000 0.000000 0.000000

cluster_10 0.000000 0.000000 0.000000 0.000000

Constraint on the portfolio

rate of return 0.030000 0.035000 0.036000 0.037000

Minimal risk measured

by standard deviation

calculated with the

scenarios matrix 9.16433E-003 1.12474E-002 1.16869E-002 1.21538E-002

Optimal value of components

cluster_1 0.000000 -0.000000 -0.000000 -0.000000

cluster_2 0.210359 0.000000 0.000000 0.000000

cluster_3 -0.000000 -0.000000 -0.000000 -0.000000

cluster_4 0.000000 -0.000000 0.000000 -0.000000

cluster_5 -0.000000 0.000000 0.000000 0.000000

cluster_6 0.681406 0.852834 0.919914 0.986994

cluster_7 -0.000000 -0.000000 -0.000000 0.000000

cluster_8 0.108235 0.147166 0.080086 0.013006

cluster_9 0.000000 -0.000000 -0.000000 -0.000000

cluster_10 0.000000 0.000000 0.000000 0.000000

Figure 1. Efficient Frontier for Problem 1

Figure 2. Efficient Frontier for Problem 2

Figure 3. Efficient Frontier for Problem 3

Figure 4. Comparison of Efficient Frontiers

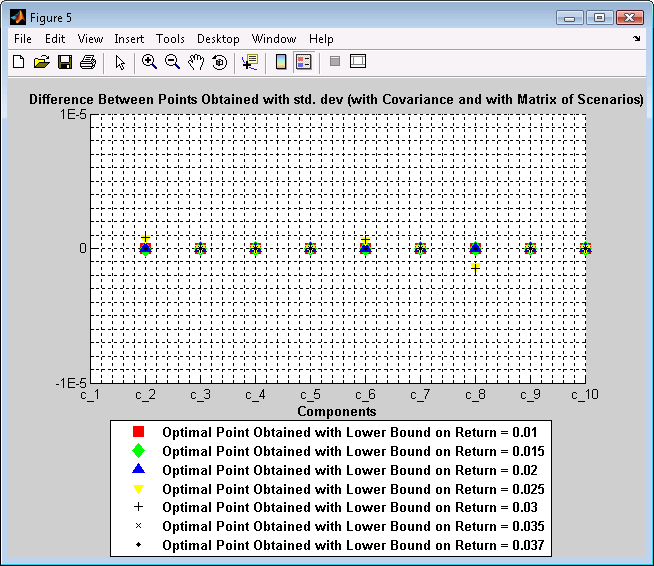

Figure 5. Difference Between Points Obtained with std. dev (with Covariance and with Matrix of Scenarios)

Figure 6. Relative Contribution to CVaR Dev.

Figure 7. Relative Contribution to Std. Dev.

Figure 8. Std. Dev Marginal (for Non-Zero Components)

Figure 9. CVaR Dev Marginal (for Non-Zero Components)

Figure 10. Lower Bound on return = 0.02